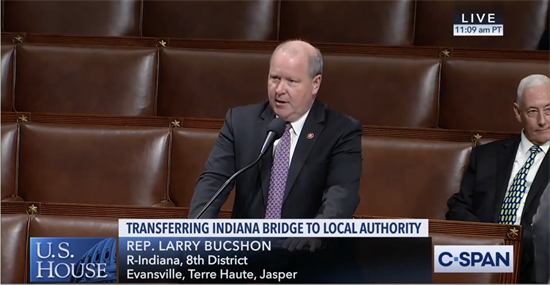

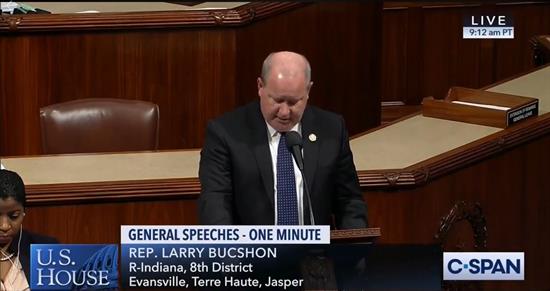

On The Floor

Speaking on the Restore the Harmony Way Bridge Act

I recently spoke on the floor as the House voted to pass my legislation, the Restore the Harmony Way Bridge Act. The Harmony Way Bridge is a local landmark and was an engineering marvel when it opened in 1930. That is why the Restore the Harmony Way Bridge Act is important. It will convey the bridge to the Indiana and Illinois Bridge Authorities and remove the federal conditions set out on the bridge. I am glad to see this bill pass the House today, and I want to give thanks to all those who have helped in this effort. Click the heading above to hear my speech.

Legislation to End Surprise Medical Bills

On July 17th in the House Energy and Commerce Committee we unanimously passed the No Surprises Act – to end surprise medical bills. As a physician, I believe it is important that patients are not financially burdened with surprise medical bills for unanticipated out-of-network care. This legislation is significant because it bans surprise out-of-network surprise medical bills and establishes an independent dispute resolution process between the healthcare provider and the health insurer that is mediated by an arbiter. Access to life saving care is critical for all Americans and it should not come with lifelong financial liabilities as a result of a surprise medical bill.

|

Supporting Public Health Reauthorization Bills

As a physician, supporting these public health care reauthorization bills is commonsense. That is why I voted to reauthorize multiple public health care bills including the Lifespan Respite Care Reauthorization Act of 2019, Emergency Medical Services for Children Program Reauthorization Act of 2019, Autism CARES Act of 2019, and Newborn Screening Saves Lives Reauthorization Act of 2019.These programs play a vital role in our communities throughout the nation in addressing the health care needs of the most vulnerable Americans. I believe these bills will help save lives.

Legislation to End Robocalls

I am pleased to stand with my colleagues on both sides of the aisle to provide relief to Hoosiers who are tired of annoying robocalls. That is why I co-sponsored and voted for the Stopping Bad Robocalls Act, which was recently passed by the House on July 24th. These seemingly endless scam calls are often criminals that are knowingly breaking the law and trying to defraud Americans. By requiring phone companies to provide call authentication technology to block calls, the Federal Communications Commission will be empowered to track down criminals at no cost to consumers.

|

Voting to Repeal Obamacare Tax on Employer-Sponsored Health Insurance

I am pleased the House has come together in a bipartisan manner to permanently repeal the burdensome Obamacare Cadillac tax that would impose a 40 percent excise tax on certain employer-sponsored health insurance. This tax would fall on certain employer-sponsored health care coverage and unfairly punished Hoosiers and Americans. According to the Tax Policy Center, if the Cadillac tax is not repealed, the effect will be lower wages and higher income and payroll taxes. While the Cadillac tax is currently not in effect, it looms large over the health benefits of Americans. It is imperative for the growth of the economy and the well-being of all Hoosiers, that we repeal this Obamacare tax once and for all.

Voting Against a Partisan NDAA

Traditionally, the NDAA process has been light on partisanship with Republicans and Democrats coming together to advance policies that support our troops and strengthen our national defense. Unfortunately, House Democrats are risking the safety and security of our freedom at home and abroad with this partisan legislation that they intend to use as a political tool. That is why I voted against this legislation due to the lack of adequate allocation of resources requested and blatant partisanship. While there are important measures within the NDAA for Hoosiers, the overall bill does not address our national security needs or adequately support our military personnel.

|

Hoosier Highlights

Honoring Eva Kor

Recently, I spoke on the House floor to honor the incredible life of Eva Mozes Kor. Eva was a friend, a Holocaust survivor, and an inspiration to us all. Eva Kor was an incredible woman of integrity, spirit, and forgiveness and her story will be shared for generations to come. May her memory be a blessing.

|

Visiting the Shelburn Depot

I particpated in the ribbon cutting ceremony for The Shelburn Depot in Shelburn, Indiana. This local landmark earned its place on the National Register of Historic Places in December 2015 and is now being transformed. Breathing life back into this historic building is the perfect opportunity for the entrepreneurial spirit to flourish right here in Shelburn.

|

Meeting with Hoosier FFA Leaders

As a father of four, I know how important it is for future generations to have hands-on experiences. I am thankful for the National FFA Organization for giving Hoosiers the opportunity to succeed through agricultural education. Great visit with the Future Farmers of America!

|

Advancing Patient-Centered Health Care

In Evansville, I had the opportunity to participate in a roundtable with Tri State Community Clinics. These clinics provide onsite comprehensive primary care services for Hoosiers, focusing on accountability and ownership. Keep up the great work!

|

Speaking in Shelburn

I spoke at the dedication of the new firehouse in Shelburn. It is for the Thunderbird Fire Protection District in Sullivan County. A great facility that along with the volunteer firefighters and EMTs will serve the community well. Thanks to Chief John Quilliam for inviting me to the event.

|

Announcing the Head Start Grant for Hamilton Center

I am pleased to announce that the Hamilton Center in Terre Haute will be receiving more than $1 million to bolster their Head Start Program. Head Start promotes school readiness of children under 5 from low-income families through education, health, social and other services. Head Start has served over 30 million children and their families in urban and rural areas in all 50 states, the District of Columbia, Puerto Rico and the U.S. territories. These hard-earned taxpayer dollars are much-needed resources that will help prepare young Hoosiers for success.